Each month, we will be choosing a country that has an incredible growth outlook and dissecting its political and economic situation. There will be a breakdown of why we have chosen the country and investment opportunities that lie therein.

Today’s COTM – INDIA

“India’s economy is likely to stand firm in an uncertain world”, according to Goldman Sachs. Recently, the nation’s economic climb has been amid the centre of global discussions. Their $3.7 trillion GDP has now surpassed the UK, ranking fifth largest in the world. The quote deduces that in a world of corrupt governments and economic insecurities, India is upholding its reputation. However, the country’s post-1991 liberalisation has come with increased income inequality. The World Inequality Report in 2022 concluded that 77% of the nation’s wealth is now held by the top 10% of earners. As our global supply chain becomes increasingly dominated by Indian goods & services, many question whether India will become ‘the next China‘, or veer towards its own unique future?

Economic Overview:

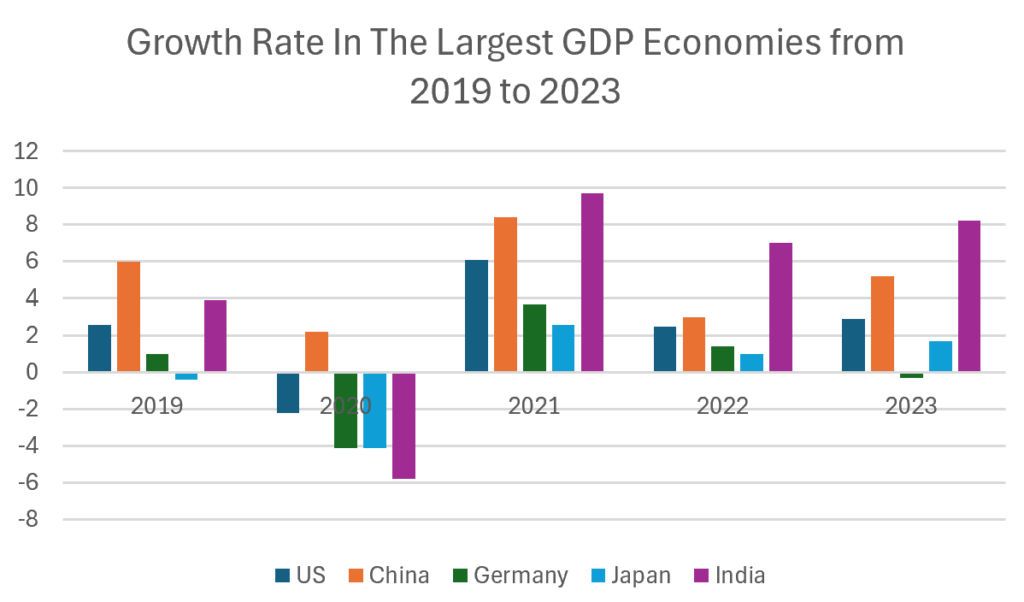

Figure 1

Currently, India’s real GDP growth rate is ranked 12th in the world, at 8.2% since 2023. Sectors driving this growth include:

- Services, including IT and digital payments, contribute to just over 50% of GDP, with the Unified Payments Interface (UPI) processing over 10 billion transactions monthly.

- Industry accounts for 27.6% of GDP, and the “Make in India” initiative has boosted domestic manufacturing.

- Agriculture: India is the world’s second-largest food producer and a leader in integrating AI agritech.

A report by the United Nations predicts a 6.6% growth in 2025 and 6.8% in 2026. Strong development in the mentioned sectors couples with favourable policies (such as corporate tax cuts or production-linked incentives) and rising domestic demand to make India a favourable destination for foreign investment.

When compared to similar developing economies, the country seems to be fairly secure. Although India’s growth rate surpasses that of China by nearly two times, China still retains a much stronger manufacturing base, and achieves a higher income per capita. However, developing economies like Vietnam and Indonesia struggle to catch up: Vietnam’s manufacturing sector is growing, but India’s market size and digital economy is far more attractive for investment.

In January 2025, India achieved a 4.31% inflation rate, nearing the Reserve Bank of India (RBI)’s target of 4% (with a tolerance range of ±2%). This has dropped from over 7% in 2022, when inflation remained persistently high due to volatile food and energy prices. However, food inflation still remains a concern, at 8.39% due to supply chain disruptions and climate-related agricultural challenges.

The RBI has maintained interest rates at 6.5%. In early 2024, they performed their first cut in nearly 5 years to stimulate investment and growth while keeping inflation under control. This reduction in borrowing costs led to increased consumer spending and capital investment – a successful outcome so far.

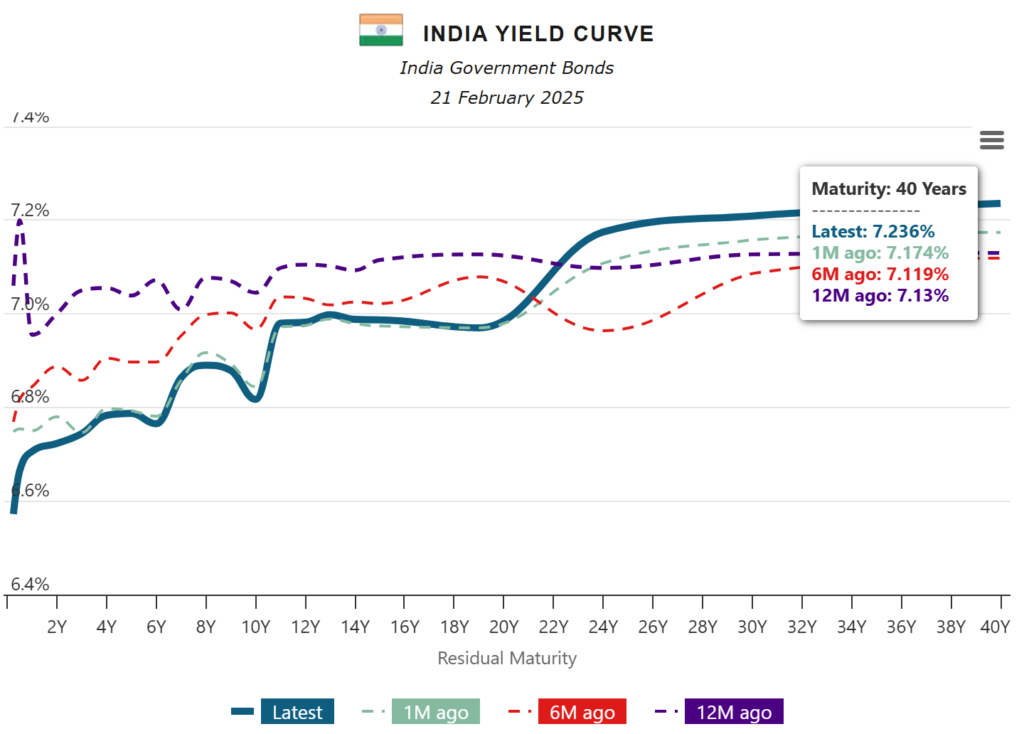

Figure 2

Currently, the Indian Rupee remains stable, trading at INR 83 per USD in 2024 Q1. Despite fluctuating oil prices and global market volatility, India’s foreign exchange reserves, which as of March 2024 have reached $615 billion, have assisted the currency out of external shocks. Bond markets have attracted foreign institutional investments (FII) ever since their inclusion in JP Morgan’s emerging bond index in 2023. As a result, yields on the 10-year Indian government bonds are currently at 6.8% and the yield curve maintains an upward slope (Figure 2). This shows that long-term rates are higher than short-term, which reflects positive expectations for both the country’s future growth and inflation control, and unveils heavy investor confidence.

Trade & Foreign Investment:

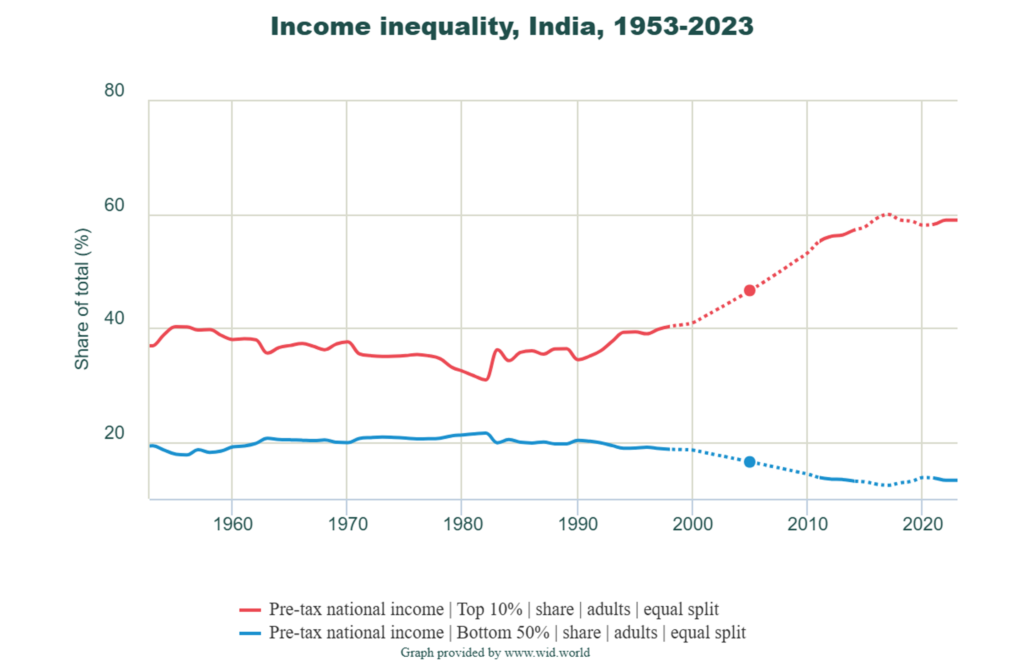

Figure 3

In 2023, the nation attracted a record of $70.9 billion in foreign direct investment (FDI), mainly for technology and manufacturing, resulting from production-linked incentive (PLI) schemes and reduced corporate rates. In comparison to similar developing economies: China generated $163 billion, Vietnam generated $39 billion, and Indonesia generated $22 billion.

India is also strongly positioned in the following global trade alliances:

- BRICS: The BRICS organisation includes Brazil, Russia, India, China, South Africa, Egypt, Ethiopia, Indonesia, Iran, and the UAE. The first summit was in 2009, consisting of only the first four mentioned countries, in a collective effort to grow the presence of emerging economies across the globe. It is an opportunity for India to expand trade amongst these nations, particularly in raw materials and energy, and is expected to make up 28% of global GDP in the coming year.

- Quad Alliance (US, Japan, Australia, India): This partners Southeast Asia, the Pacific, and the Indian Ocean. It collates a support base for infrastructure, technology, climate change prevention, and defence, building India’s supply chain resilience.

- G20 Leadership: India led the G20 in 2023, which improved their economic influence and allowed the nation to secure several important infrastructure investments.

- China: Despite political disagreements, China is by far India’s largest trade partner, importing $98 billion in 2023. Generally, China imports electronics, machinery, and chemicals, while India exports pharmaceuticals and raw materials.

- India-EU Free Trade Agreement: An agreement with the European Union allows for a powerful trading partnership, boosting investment and reducing tariffs.

The country has implemented several policies to boost their global trade position:

- “Make In India”: By 2013, India’s growth rate has fallen to its lowest level in a decade. This initiative was set in place to promote the country as a global manufacturing hub. It increased domestic manufacturing, reducing reliance on imports, and attracting numerous tech giants such as Apple, Samsung, and Tesla. Furthermore, it promoted exports, reading $776 billion in 2023. India is now a leading exporter of pharmaceuticals, IT services and petroleum, particularly to the US, UAE, and EU.

- Tariffs & Policy Changes: Recently, trade agreements with the UAE and Australia have boosted access to textiles, electronics, and agricultural goods.

- China Alternative: Companies concerned about China’s geopolitical tensions are relocating to India, who offer similar costs for manufacturing.

Despite strong pushes for domestic production, India’s trade deficit remains at $211 billion because of high crude oil, electronics, and gold imports. However, their rising digital presence and heavily growing manufacturing base position the economy has a centre of global trade, attracting substantial amounts of foreign investments.

Labour Market:

An essential driver of India’s successful growth is their young, growing population. India’s median working age is 28 years (compared to China’s 39 years). In 2023, India created 12 million jobs. However, evidence suggests that this growing population is not contributing effectively to the economy. Although jobs have been created, unemployment remains at 7.8%, and while the economy has one of the strongest IT sectors, 30% of graduates lack employable skills; this in turn proves that the government’s education and training programmes are not sufficient.

Challenges Facing the Economy:

Figure 4

- Income Inequality: India’s Gini coefficient – a reliable measure of income inequality – reached 0.41 in 2023, positioning the country on the lesser end of average global inequality. An act of liberalisation, privatisation, and globalisation, initiated in 1991, set out goals to accelerate economic growth. It boosted the economy, yet created an environment where the rich could capitalise on the new opportunities at the expense of the poor. The proportion of the country’s wealth from the top 1% of earners rose from 12% to 22%; the bottom 50% experienced a decline in their income share.

- Infrastructure Challenges: To keep up with development goals, the nation requires $2.2 trillion by 2030 – a compound annual growth rate of 10.1% from 2024-2030. To accommodate for the rapidly growing urban population, an estimated $55 billion must be spent on urban infrastructure annually. However, infrastructure investments have been stuck around 5-6% of GDP in recent years (an insufficient amount to meet projected needs). Addressing the gap is necessary for sustaining India’s economic momentum. Numerous efforts have been put in place to close the gap, such as the National Infrastructure Pipeline (NIP), which aims to invest about $1.5 trillion between 2020 and 2025.

- Regulatory Issues: The Economic Survey 2024-25 highlighted a need for deregulation to boost India’s global competitiveness. Furthermore, foreign companies often face extended tax investigations, potentially deterring investment. A recent example is India’s demand for $1.4 billion in back taxes from Volkswagen after a 12-year investigation. Similar automakers are collectively disputing about $6 billion in taxes relating to income and customs.

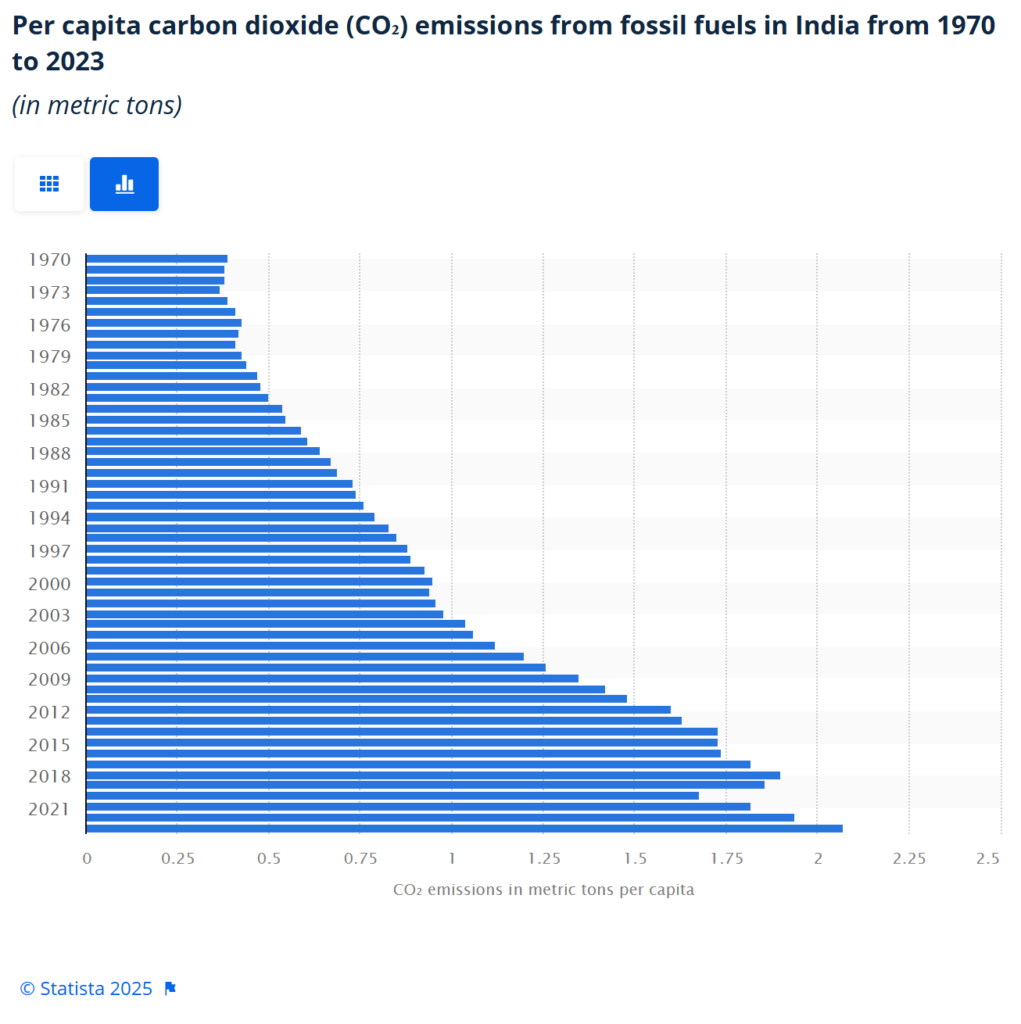

- Environmental Concern: India’s emissions per capita have been rising with their population, leading to mounting total emissions at an uncontrollable rate (up 6.1% in 2023). As a result, air pollution as led to increased healthcare costs and reduced labour productivity.

Figure 5

India’s Competitive Advantages in the Development Race:

- Growth Engine: India contributed to approximately 16% of worldwide expansion in 2023. It is one of the fastest growing economies and Figure 1 shows how in recent years it has been catching up to others in the top 5 GDP.

- Young Workforce & Digital Leader: Their young workforce, who are increasingly ending up as stem graduates, are placing the country in an advantageous position when it comes to sectors such as technology and services.

- Manufacturing: Low labour costs, government incentives, and supply chain diversification efforts make manufacturing a vital advantage for the country.

- China+1: Increasingly, India is offering cheaper labour, and expanding on initiatives such as “Make in India” and the Production-Linked Incentive scheme. They have a more stable government and predictable regulatory environment than economies like China. This makes it more attractive for foreign investment and production. Many wonder whether India will overtake China as the next global manufacturing hub?

- High FDI: As mentioned earlier, the economy is now in a remarkable position in terms of their tech services, manufacturing capabilities, and economic stability. This is particularly attractive for foreign direct investment since investors are confident that their money will be well spent and generate great returns.

- Stable Leadership & Good Business Environment: India has a democratically elected government with clear economic policies which support long-term growth. The government has implemented corporate tax cuts and simplified labour laws to ease doing business in their country. Although there are bureaucratic challenges, India is improving dispute resolution mechanisms for businesses. The leadership engages in FTAs and constantly attempts to strengthen economic ties. With stable governance and assisting policies, India provides a promising business environment.

Future Policies & Plans:

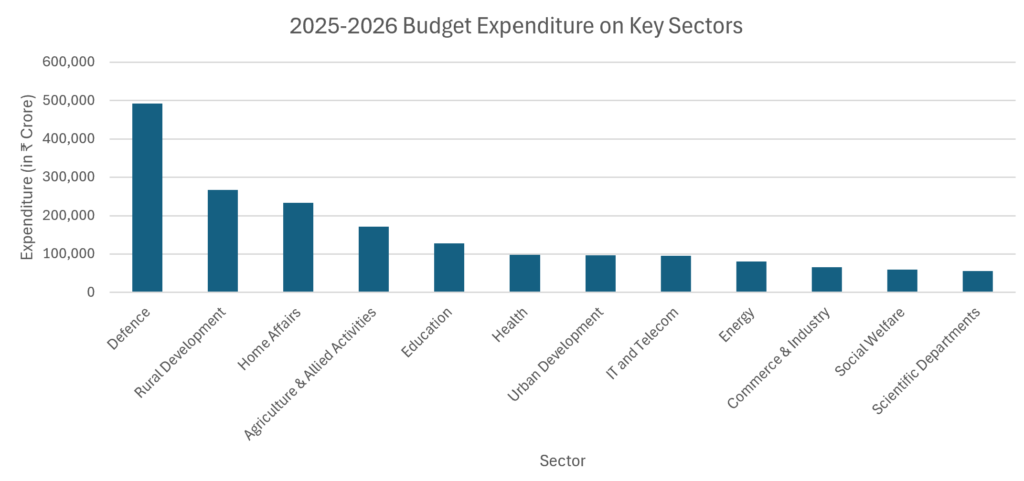

Figure 6

The budget prioritises defence and rural development, demonstrating a focus on national security and economic strength (Figure 6). Investment in agriculture, education, and health defines efforts to improve labour efficiency, human capital, and rural success – areas that vitally need to be boosted in India.

Plans include the Production-Linked Incentive (PLI) scheme, an effort to increase domestic manufacturing and exports. It continues to attract investment (especially in electronics pharmaceuticals, and renewable energy). Meanwhile, India is negotiating FTAs with the UK, EU, and Canada, again, to grow its export base and grow deeper into global supply chains. India has committed to achieving Net Zero by 2070 – although it is a very long-term vision – and has increased spending on renewable energy and innovation.

The countries future appears stable and promising. However, the government must prioritise tackling inequality – a difficult obstacle considering their ambitious goals for growth and infrastructure. The question is whether the government will be able to effectively coordinate all of these eager promises, or fall short of expectations and lose their phenomenal momentum?